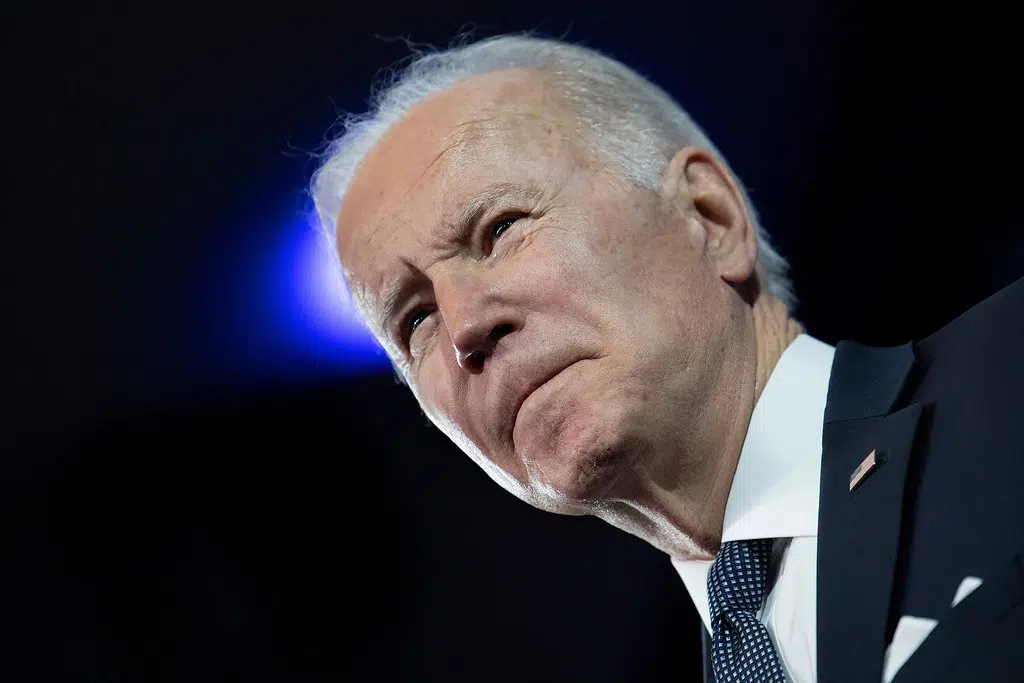

CONLEY COMMENTARY (WSAU) – Joe Biden’s federal budget, unveiled last week, raises taxes on those earning more than $400,000 a year. The revenue raised will shore up the medicare trust fund, keeping it solvent beyond 2050.

Let’s stipulate that I’m well below the $400,000 income threshold to pay the higher taxes.

Still, I will stand up and say this is unfair.

Why? For starters, someone earning that level of income is unlikely to be on medicare. They earn enough to have their own private insurance. And the tax they’ll pay, $20,000 a year, is more than enough to pay their own private policy. So they are being asked to shoulder a tax hike to pay for a program that are unlikely to use.

The rich are being told to go to a restaurant, not eat anything, and pay for the meals of all the other customers.

And the op-ed in the New York Times last week, credited to Joe Biden although he certainly didn’t write it, askes the rich to “pay their fair share.”

The next time you hear that, yell at your TV screen: “and how much is that?” Notice how the pay-your-fair-share crowd never ever puts forward a percentage or a dollar amount that they deem to be ‘fair’.

Should an individual’s tax bill be capped? Perhaps after the pay in $1,000,000? That’s more tax than I will ever pay in my lifetime. What’s the highest percentage of income that someone should pay? If you’re wealthy and live New York State, where there is federal, state, and local income tax, 54-percent of your income goes to the tax man. In California, it’s 56-percent. And those people are still told they’re not paying their fair share. They’ll have a little more of their income confiscated to pay the higher Biden medicare tax.

The truth is that confiscatory tax rates are counter-productive. A Californian who has $5,000,000 in the bank has no incentive to work or to invest. Why would they? The government takes half. Instead they’ll put all their money into municipal bonds. They’ll live tax free off the interest and let the rest of us pay for everything else.

Chris Conley

Comments