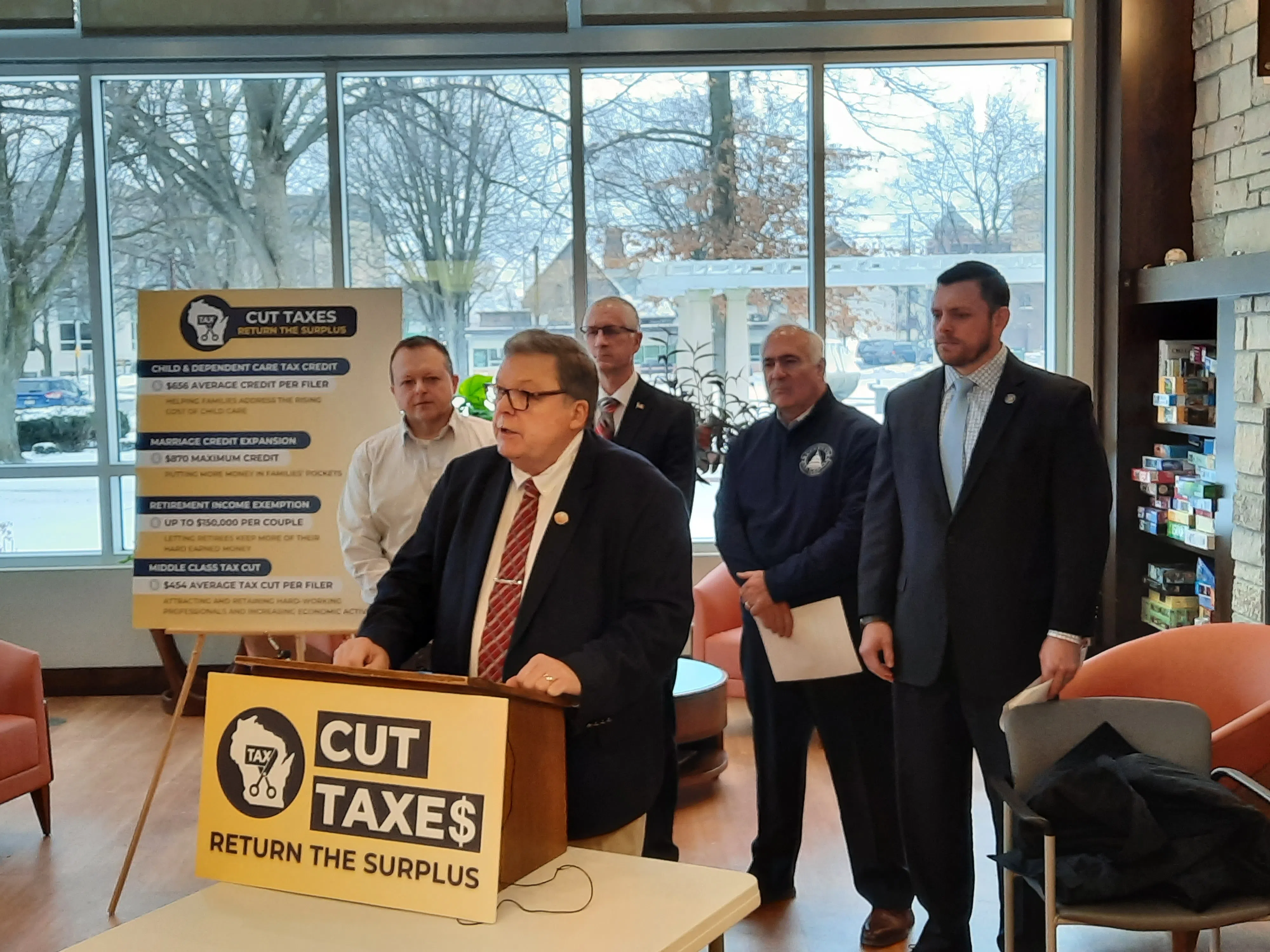

Republicans announce tax cut proposal in Wausau. MWC photo by Mike Leischner

WAUSAU, WI (WSAU) — Republicans in the Wisconsin Assembly and Senate rolled out a new tax cut proposal on Tuesday.

State Representative Pat Snyder of Schofield says the proposal represents a scaled-back version of the previously proposed $3 billion cut that was vetoed by Governor Evers. “This takes it down to $2.1 billion which leaves more in the surplus. I think it’s also more in the Governor’s range, especially the middle-class tax cut.”

The plan encompasses four separate bills that would lift the top line of the state’s second tax bracket from $38,190 to $150,00 for a married couple filing jointly. Another bill would eliminate state taxes on retirement plan distributions including a 401(K), IRA, or company pension. Other bills expand the Child and Dependent Care Tax Credit to 100% of the federal credit and increase the married couple credit to $870. That number had been at $480.

Snyder says the plan leaves rates for the state’s two highest tax brackets unchanged, putting the majority of the tax relief on the middle class and retired individuals who have been feeling the impacts of inflation for more than a year. “[A lot of Seniors] are on fixed incomes. We don’t want them to leave their homes or leave the state. This makes sure we can give them some extra help along with the middle-income folks who might be working two jobs. Let’s get them more money in their pockets.”

State Senator Patrick Testin was also on hand for Tuesday’s announcement in Wausau. His staff released a statement following the event, saying he supports the proposal and hopes it will reach his chamber soon. “Cutting taxes on the middle class will provide a tremendous benefit to Wisconsin by attracting young professionals, retaining the ones we currently have and bolstering economic activity throughout the entire state,” Sen. Testin said. “Expanding the child and dependent care tax credit will also make it more affordable for families to have children while remaining in the workforce. Last but not least, exempting retirement income will allow for grandparents to live closer to their growing families without incurring a higher tax burden.”

Both Testin and Snyder noted that budget surpluses mean the Government is over-taxing residents and can afford to scale back. “We want to strategicly get the money back to the different groups that really need it to help them fight inflation and everyday costs. That’s our main goal and I think that’s also the goal of the Governor,” said Snyder.

He added that the measure is for the people, and not a political stunt in an election year. “If we were worrying about just getting elected we would run on his past vetoes. This is stuff that we are serious about, we want to get money back to the folks and meet the goals that Governor has as well.”

The announcement came at a series of regional press conferences. Snyder says details of the plan were not shared with Governor Evers before Tuesday’s unveiling. The bills are currently circulating for co-sponsors and will likely be introduced next week.

If passed some of the measures including the middle-class tax adjustments could be put in place by August, meaning residents would get the break later this summer.

Comments